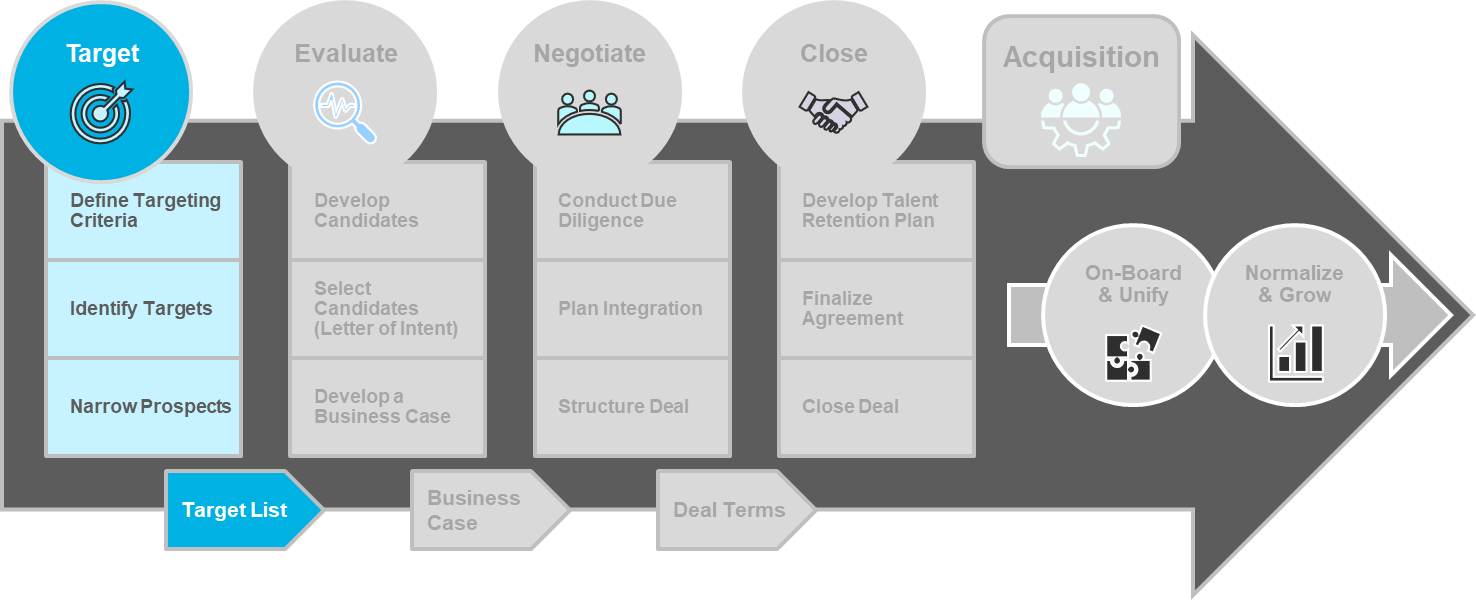

In the last blog in this series, we outlined a deliberate process to help Professional Services firms make the best business acquisitions based on their strategic, financial, and growth goals. Targeting potential acquisitions is the first step in the process.

The objective of this phase is to create broad list of possible targets that fit the strategic criteria and narrow the list to a “short list” of prospects that will be contacted to begin mutual evaluation.

First, the targeting criteria for strategic fit are developed. Depending on your needs, each criterion may require a unique acquisition, or one target may meet multiple needs. (This situation is further considered as you narrow the prospects.) When determining the criteria for strategic fit, consider the following as it relates to your portfolio strategy:

- What capability and intellectual property (IP) gaps do you want to fill?

- What are the greatest challenges facing your customers that want to help solve?

- What capabilities or IP do we currently have that we want to augment?

- What new markets and/or customers are you trying to enter?

- If applicable, what gaps in technology are you looking to fill?

- Which executive buyers do you want to have greater intimacy with or greater access to?

After defining the criteria, you can build a list of possible acquisition targets. This step often entails:

- Researching potential targets in trade publications, professional organizations, and online,

- Leveraging team knowledge and referrals, and

- Engaging clients to help identify targets.

At this point, you will want to think very broadly about potential targets to ensure sufficient options are available and opportunities are not missed.

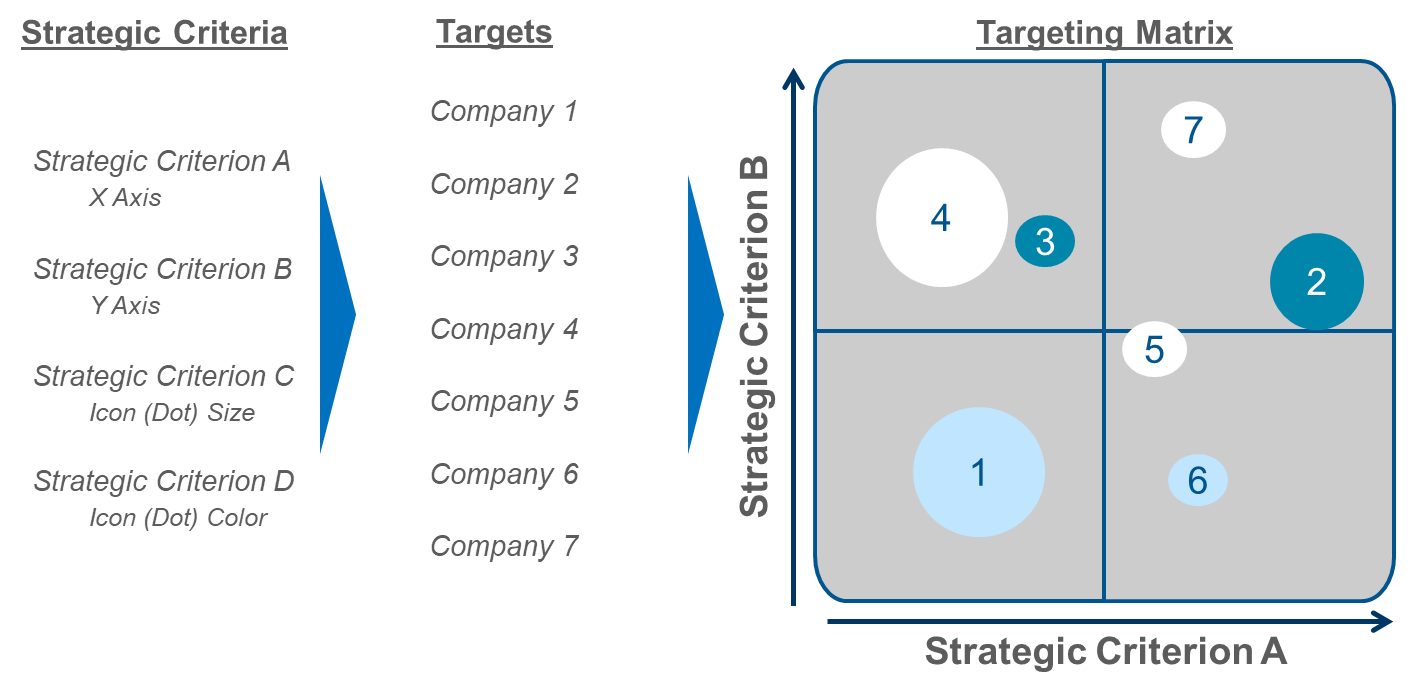

Finally, you will narrow the targets to a viable list of prospects for more detailed evaluation. Placing the targets on a “Targeting Matrix” will assist you to visualize the relative merits and challenges across the full range of targets. Often this exercise will further clarify your priorities.

Typically, a basic 2×2 of what you believe are the most important strategic criteria the best starting point for the matrix. Additional criteria (such as size, breadth of the target’s portfolio, industry or segment focus, or complementary non-PS offerings) can be captured visually by size, color, shape etc. of the icons in the matrix. Targets that meet multiple criteria are often a better “fit” in the Target Phase.

In this example, companies 2 and 7 have a strong fit for both primary criteria. Size and color of the icons would provide further insight. Additionally, depending on the importance of the criteria A and B, other targets may prove attractive or be ruled out. In a recent client example, one axis represented exclusive focus on an industry segment and the other axis represented exclusive topical focus. After seeing the matrix, the client determined that the industry segment focus was essential, thereby eliminating a substantial number of targets from consideration.

After using the Targeting Matrix to hone your criteria and narrow the target list, you are ready to move to the Evaluate Phase.

Written by: Doug Long and Sarah Cushman

About the Authors:

Doug Long is a Partner with McMann & Ransford and has more than 26 years of experience in consulting across various industries, topics, and client challenges. Prior firms include Deloitte and GE. He currently leads our Healthcare Practice.

Sarah Cushman is a Senior Consultant with McMann & Ransford and has experience working with Fortune 500 companies to solve complex challenges, drive differentiation, and create long-term value.