In this blog series, we will begin discussing the important issue of how to play – how to organize the go-to-market assets to address different account categories and different business models – hardware products, software products, services, professional services, outsourcing etc. The goal of a “how to play” model is improving the ability of the portfolio to drive greater revenue/margin more easily.

Clear financial objectives must be created for each type of account. Creating achievable financial goals require more than just applying a growth rate to historic performance in each market. Doing so effectively depends on having a deep understanding of the customers in a given market’s core business, current market dynamics/pressures, and the market’s key strategic issues and initiatives. In addition, clarifying financial objectives requires the mastery of managing multiple business models, service lines, and offerings and determining where they fit in an account and its journey.

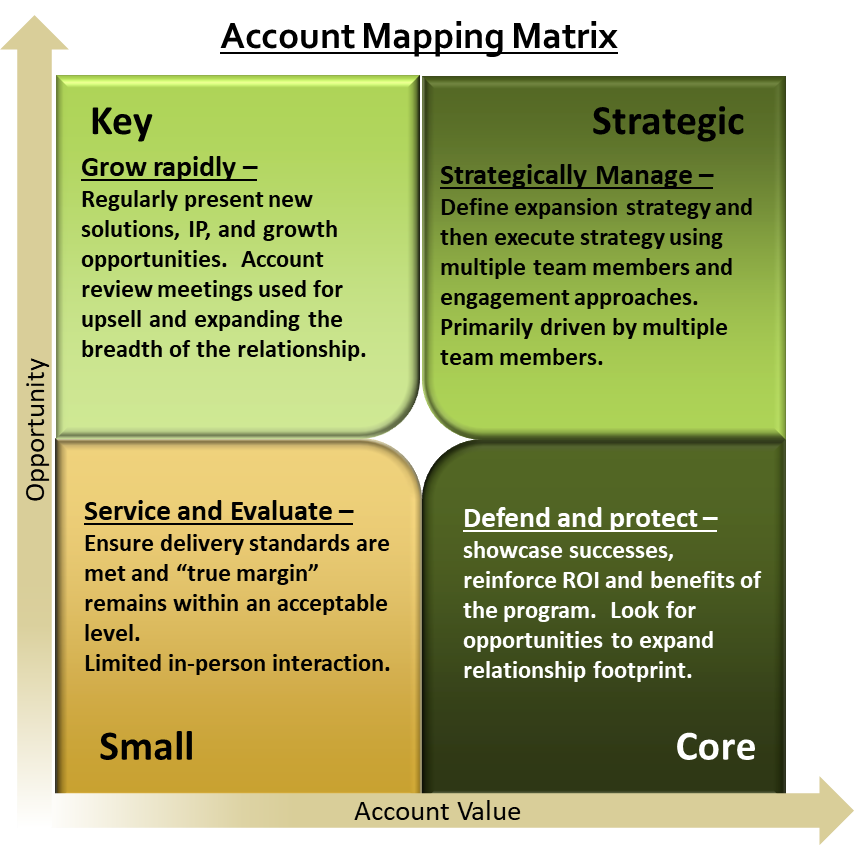

Category 1 (Strategic) – High-value accounts where you make your money – What percentage of revenue should come from your largest/best/most strategic accounts? This should be a significant percentage (~60%) of the revenue generated from this account category. If not, then that points to a challenge of getting meaningful share of wallet – this is both a portfolio problem and a leadership challenge to work with customer journeys, not sales transactions.

Category 2 (Key) – Accounts with high growth potential – The next category includes accounts that look like our largest/ best/ most strategic accounts but aren’t providing the financial value that they should or could. These Key accounts are the primary growth accounts. Included in this group should be your competitors’ key accounts – it is always fun to take away the best accounts from competitors. The target percentage for these growth accounts does not go directly into the annual plan but does give you clarity on what should/could be happening. Additionally, as your business matures and you develop the ability to manage multiple business models, your confidence in growing and/or penetrating these accounts will improve; therefore, your ability to predict outcomes improves.

Category 3 (Core) – Accounts that can be managed with a low-cost service model – For the next account category, we suggest analyzing where you can move to a more self-serve relationship. Service models for these accounts reduce onsite visits and may include leveraging a community consulting model to maintain intimacy, using inside sales to contact accounts, etc. These accounts are attractive when you can lower the service cost and improve the margins. If served in a cost-effective manner, what can you expect to yield from this type of account?

Category 4 (Small) – The conundrum accounts – Finally, for accounts that are not strategic and do not have a low-cost service model, we suggest conducting a strict analysis of their value and how best to serve them. This usually results in a combination of the strategic account journey approach and the low-cost service approach. Also, are there account categories that do not currently exist but could in the future? These may be an important input into planning in the future. If you can be effective at adding more high-value accounts, then the percentage of the accounts that fall into this category dwindles as they either “move up” or are weeded out over time.

In the next blog we will discuss account journeys.

Written by: Dean McMann

About the Author: Dean McMann is a Founding Partner at McMann & Ransford with 35+ years of experience in consulting and professional services. He is a sought-after expert and speaker on topics of: B2B differentiation, professional services best practices, and overcoming commoditization. In addition to his extensive experience in the Professional Services space, Dean also serves on the board of various non-profit organizations.