As discussed in this blog series, most agree that Portfolio plays a strategic role, yet we consistently see organizations use portfolio as a catch-all at the end result of market sizing and R&D. Oftentimes, organizations fall prey to a “Typical State” portfolio that acts as a broad offer/sales catalogue over time.

As discussed in our 2nd blog in this series, there are 3 significant decisions to make when building a market-back portfolio that addresses your customers’ needs and drives significant value for both them and your organization. Our most recent blog in this series focuses on decision #2: What challenges do customers have that need solving and/or what opportunities do they have that we can help them create?

In this blog post, we focus on decision #3: What solutions can we provide to address those challenges and opportunities? Key considerations when making this decision:

- Your Existing Solutions – Determine how and where they fit into the target

sub-segment and their objective. It is important to be honest and admit reality: force-fitting existing solutions to problems can hurt your credibility and future opportunities.

sub-segment and their objective. It is important to be honest and admit reality: force-fitting existing solutions to problems can hurt your credibility and future opportunities. - Potential New Solutions – There is never a shortage of ideas; the challenge is deciding which ones to pursue given an almost unlimited supply of ideas. Therefore, you need a deliberate and organized manner to filter them into a short list of those worth commercializing.

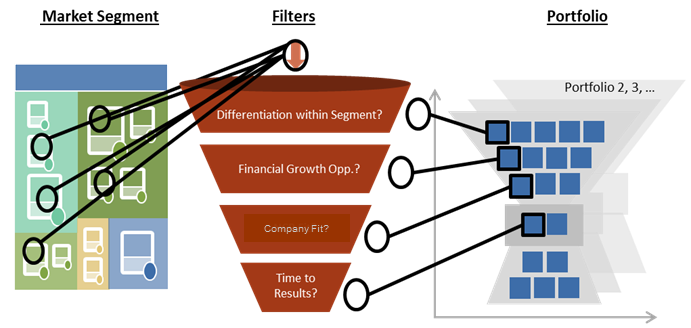

A Sample Framework for Evaluating Potential New Solutions

The goal is to identify ideas that bring differential and financial impact as quickly as possible. Thus, this approach identifies failure points early in the process so you can adjust or simply table the Idea for a later time.

We find that a simple funnel concept helps narrow the choices for which new solution ideas are worth pursuing by answering the following questions:

- What are the customer’s business case drivers for

- addressing the problem

and how material are they?

and how material are they? - What are the economics for solving the customer problem (big picture value)?

- How does your approach compare to the customer’s alternatives?

- What skills, capabilities, and technologies are required and how well do they fit with what you have (or can get)?

In our experience, items #1 and #2 are difficult because companies often do not really know the answer. And many organizations oversimplify the answers to items #3 and #4, which leads them to taking undifferentiated solutions to the market. Again, being objective is important to this step when building an impactful market-back portfolio.

Therefore, our next blog in this series will focus on prioritization criteria to get a result that is as objective as possible.

Written by: Mark Slotnik

About the Authors:

Mark Slotnik has spent nearly 20+ years advising clients in the areas of designing and taking to market high-value business solutions, solution portfolio management, talent development, resource management, business process re-engineering and commercial software.