As discussed in our 1st blog in this series, most companies agree that a Portfolio plays a strategic role, yet we consistently see organizations use portfolio as a catch-all at the end result of market sizing and R&D. Oftentimes, organizations fall prey to a “Typical State” portfolio that acts as a broad offer/sales catalogue over time.

As discussed in our 2nd blog in this series, there are 3 significant decisions to make when building a market-back portfolio that addresses your customers’ needs and drives significant value for both them and your organization. This blog focuses on decision #2: What challenges do customers have that need solving and/or what opportunities do they have that we can help them create?

Another way to think about this is to truly understand the objectives your customers in key sub-segments have that you can help them address. Key considerations when making this decision:

- Conduct your own research – obtain feedback from direct customer

interviews – in addition to electronic surveys – and gather insights from your market-facing resources. Also leverage but don’t rely on market publications/ reports; if the information is in those reports, it is often either too generic or you are too late and therefore run the risk of being undifferentiated in the market.

interviews – in addition to electronic surveys – and gather insights from your market-facing resources. Also leverage but don’t rely on market publications/ reports; if the information is in those reports, it is often either too generic or you are too late and therefore run the risk of being undifferentiated in the market. - Put yourself in the shoes of individual buyer personas – e.g. the CFO’s objectives are often much different than the CIO’s, and even the organization as a whole.

- Be careful of overweighting one customer’s situation – that often results in many custom solutions.

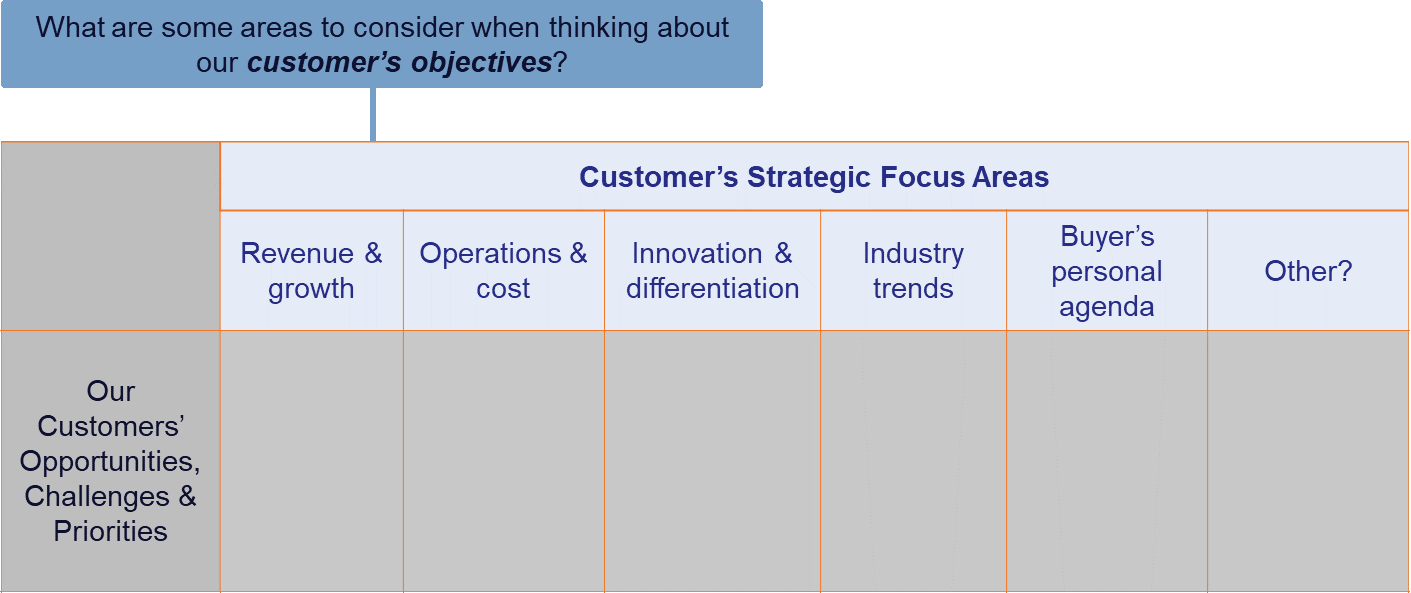

A Sample Framework for Determining a Segment’s Key Objectives

Doing the above leaves you with a lot of data that has been gathered that now needs to be organized to “triangulate” on those key items that truly matter and need solving in the market. As you can imagine, using many sources and focus areas can provide a lot of possible areas to address, so taking the time to assess it all is important to develop a few key insights that are valuable and actionable. We find that a simple framework helps define what is truly important and worth solving for:

For example, in the Community Financial Institution (CFI) sub-segment of the financial services market, we discovered that branch expansion may be limited due to federal restrictions, so many in this sub-segment are looking for innovative strategies to increase the member/customer base in new regions without the ability to build new branches. Another example is in healthcare systems and hospitals that have nursing schools. We found that many are not able to hire as many newly graduating nurses as they want/need even though they are in their own educational program. Hence, there is a need to understand why and provide a solution.

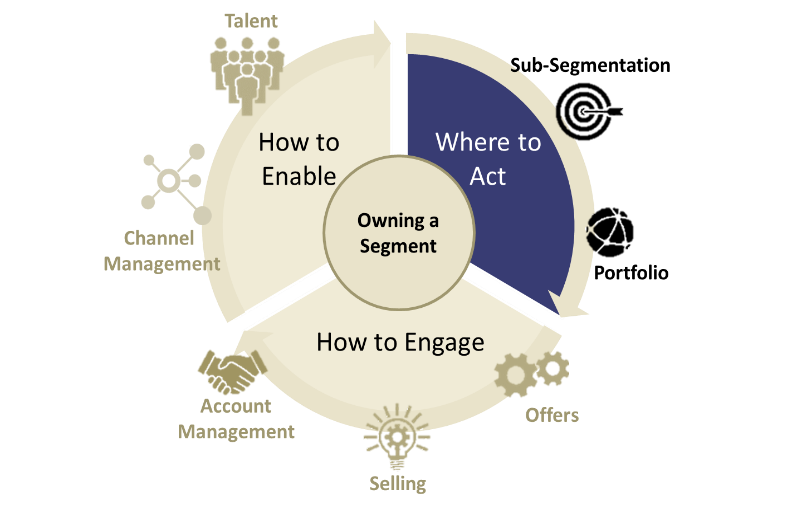

Remember, there are 3 significant decisions to make when building a market-back portfolio that addresses your customer’s needs and drives significant value for both them and your organization:

- What market segments and sub-segments are you truly targeting?

- What challenges do they have that need solving and/or what opportunities do they have that we can help them create?

- What solutions can we provide to address those challenges and opportunities?

We will dive into the last one and its implications in the next blog in the series.

Written by: Mark Slotnik

About the Authors:

Mark Slotnik has spent nearly 20+ years advising clients in the areas of designing and taking to market high-value business solutions, solution portfolio management, talent development, resource management, business process re-engineering and commercial software.