Our recent blog explored some of the unique dynamics in acquiring Professional Services (PS) firms to expand the portfolio and enable an existing PS business to make a greater impact on the customer and the overall business. While the principles discussed apply to any growth-oriented PS business, they are particularly important for embedded PS businesses making the transition from product attached to outcome-based.

The challenges of finding acquisitions that fit your portfolio strategy, work in the correct segment(s), provide differentiated IP, contribute materially to critical mass, and are available/interested in selling combine to create a constant tension between finding the best option and finding a “good enough” option. Therefore, whether your intent is to make a single acquisition or several, you must consider a broad range of options and manage this complex process holistically and dynamically – each step with one prospective acquisition may impact the attractiveness or viability of other targets.

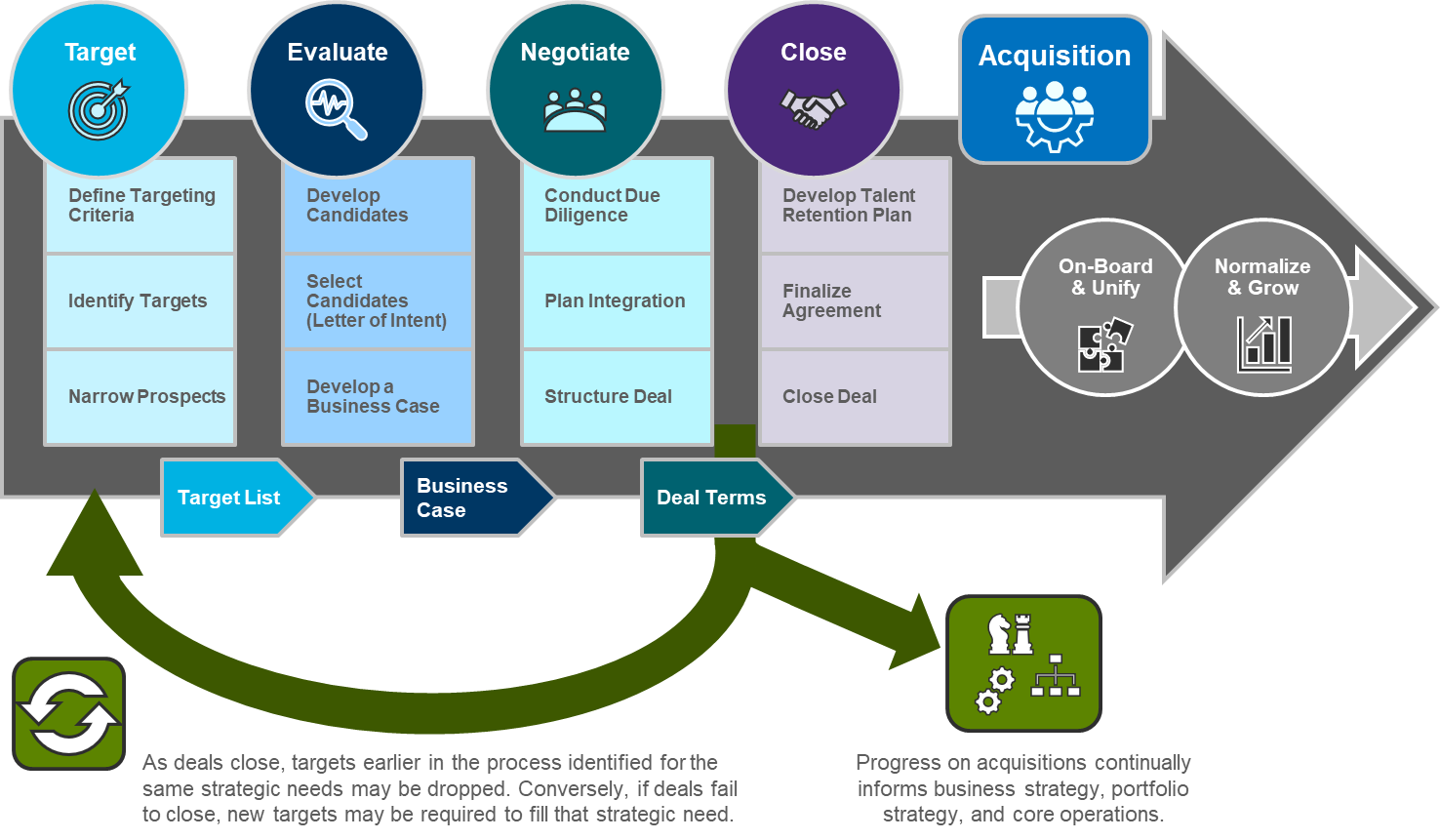

The four-phase process shown below takes you deliberately through finding targets that fit with your strategic objectives, evaluating candidates to build a robust business case, negotiating a mutually beneficial deal structure, and finalizing the deal while mitigating critical risk factors. Following this process will help ensure that the acquired firms will propel the growth engine for your business by:

• Achieving customer outcomes,

• Building greater customer intimacy,

• Introducing you into new market spaces,

• Pulling through other services, and

• Enhancing brand credibility with executive buyers.

Additional blogs in this series will delve into the detailed steps for each of these phases.

Written by: Doug Long

About the Author: Doug Long is a Partner with McMann & Ransford and has more than 26 years of experience in consulting across various industries, topics, and client challenges. Prior firms include Deloitte and GE. He currently leads our Healthcare Practice.