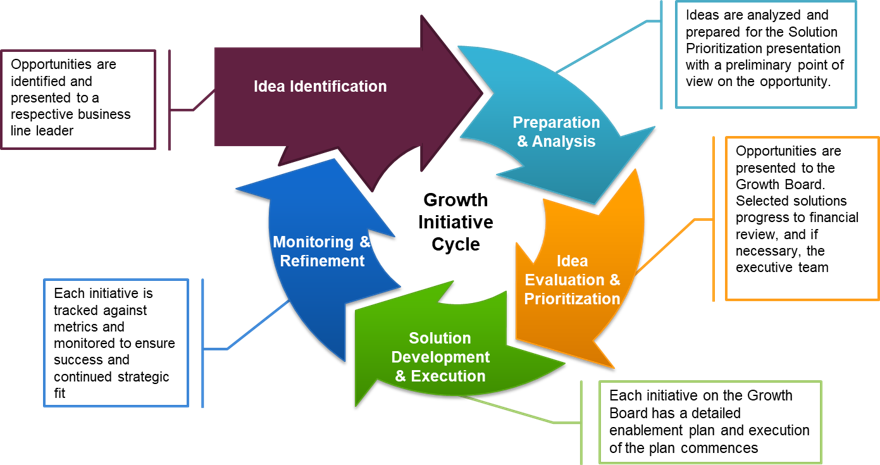

All businesses must manage competing priorities and limited resources when determining how to develop and deploy new solutions to remain relevant in the market. As businesses grow and build out new offers, it’s imperative to formalize a process to evaluate, consolidate, and align new topics to the organizational strategy. This blog walks through the Growth Initiative Cycle, a deliberate process to facilitate decision-making and help organizations ensure they are investing resources in areas where they will make the greatest impact.

Step 1: Idea Identification:

The first step of the process is to bring some ideas to the table.

Ideas should flow from different levels of the organization on two timeframes.

- Ideas can be presented on a regular cadence (e.g., quarterly) to create a predictable structure for continuous growth and improvement.

- Ideas can be presented opportunistically, based on the demands and circumstances of the market. If a great idea for a new offer pops up, it can be entered into the Growth Initiative Cycle ad hoc so the organization doesn’t miss the window of opportunity.

Step 2: Idea Preparation and Analysis:

Idea sponsors present a business case around each idea, detailing the financial and strategic implications of investing in the solution.

Once an Idea is initially vetted, the Sponsor of the idea (either the individual who proposed it or a leader representing the individual’s Idea) builds a business case for it, detailing the:

- ROI – what’s the NPV of the opportunity?

- Strategic Importance Estimation – how strategically important is this Idea to the business’s portfolio?

- Time to Market Impact – how long will it take to get the solution up and running?

- Difficulty Estimation – how much effort is required to take the solution from conception to execution?

Step 3: Idea Evaluation and Prioritization

In the Idea Evaluation and Prioritization phase, the Growth Board vets the solutions and weighs them against one another to determine which ones will progress to development.

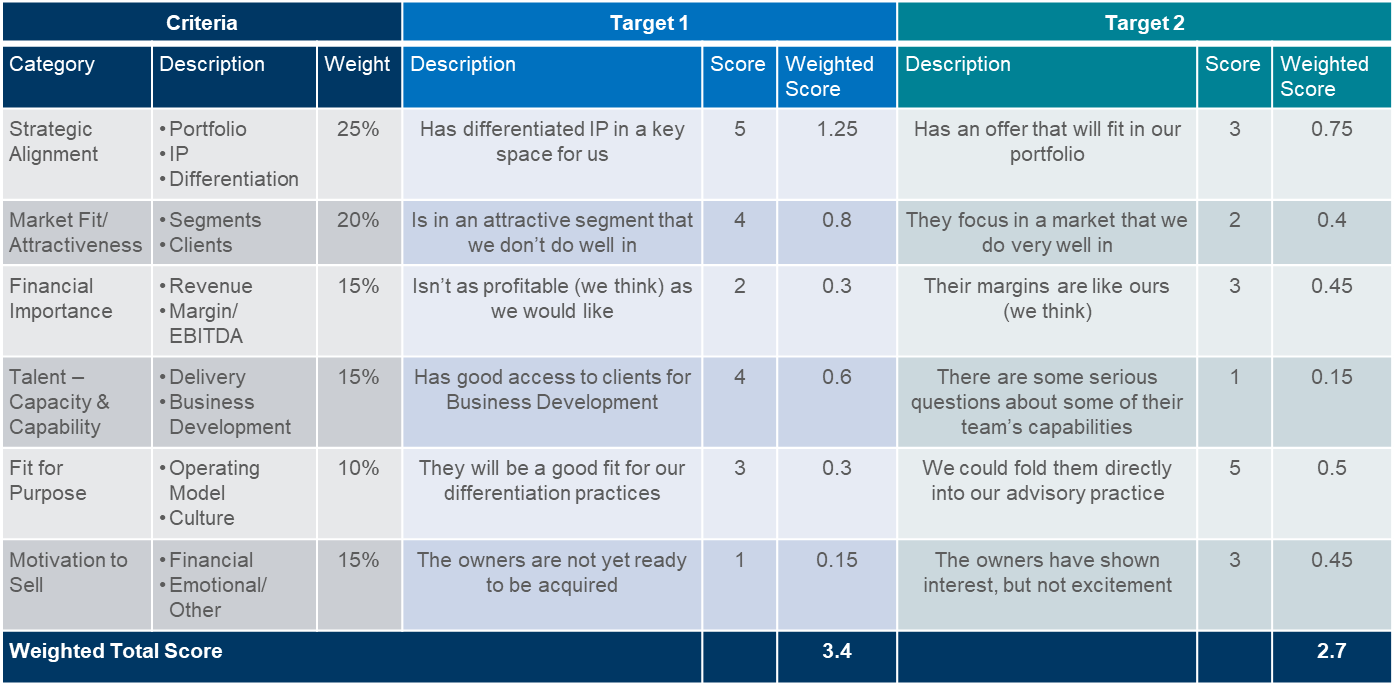

Once Ideas are formalized and analyzed through the business case, they are vetted and reviewed by the Growth Board. The role of the Growth Board is to weigh each solution for approval/investment after a formal presentation and discussion. The Growth Board prioritizes which solutions should be pursued by comparing them across a handful of criteria including: risk, speed to impact, strategic role (offensive vs. defensive), alignment to strategic direction, etc. These criteria should be agreed upon in advance and weighted based on their relative importance to each other – for example, if limiting risk is part of the corporate culture, something with a low investment risk may win-out over all other options.

Step 4: Solution Development and Execution

Solution development is planned and the requirements and detailed timeline are defined.

At this stage, the development for the approved solutions requires planning and enablement. This starts with high-level phased planning, including stages of operationalization and funding.

This phase entails building an Enablement and Execution Plan, which typically includes the following:

- Detailed timeline of activities

- Ownership of each activity and who will be involved at each level

- Talent requirements

- Steps to acquire or move talent internally

- Capability requirements

- Steps to acquire or move capabilities to needed areas in the business

- Training requirements

- Determining gaps and pressure testing the plan

- Sales models and GTM models for the Solution

- Budgeting for each activity

- KPIs and tracking metrics

With the development plans in place, the organization can move into the final step of the process.

Step 5: Progress Monitoring & Reevaluation

Solution reviews are implemented to ensure that solution development and roll-out are on-track.

Finally, each solution should be tracked to determine the success relative to the expectations determined during the previous phases. Incorporating review checkpoints into the cycle is critical to serve as both 1) “off-ramps” if an investment is not living up to expectations and there are opportunities to change paths or “get out”, and 2) input into refining the evaluation process moving forward. The progress of each ongoing initiative should be openly discussed with the Growth Board and other key stakeholders on a regular basis. A way to manage this is through quarterly reviews with the Growth Board and monthly reviews with the business units and leaders responsible for implementation.

This continuous Growth Initiative Cycle protects the business’s time, energy, and resources for the initiatives that matter most. Successful implementation leads to meaningful solutions that respond to market needs and are aligned with the organizational strategy and portfolio.

Written by: Sarah Cushman

About the Author:

Sarah Cushman is a Senior Consultant with McMann & Ransford and has experience working with Fortune 500 companies to solve complex challenges, drive differentiation, and create long-term value.

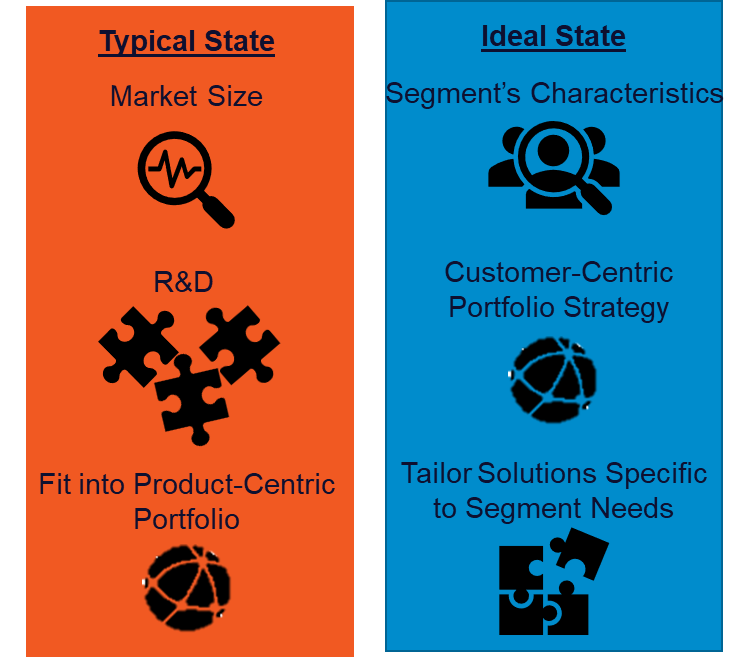

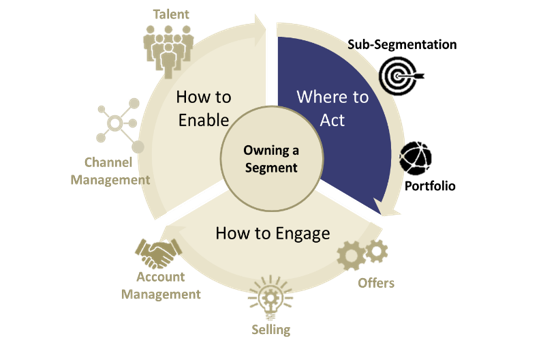

teams, etc. This doesn’t mean you won’t sell to other portions of the market, but there needs to be a target customer profile on which you base a new solution (or set of solutions). The narrower that profile is, while still being large enough to be financially meaningful to the business, the better, because your solution will be more tailored to their specific needs.

teams, etc. This doesn’t mean you won’t sell to other portions of the market, but there needs to be a target customer profile on which you base a new solution (or set of solutions). The narrower that profile is, while still being large enough to be financially meaningful to the business, the better, because your solution will be more tailored to their specific needs.