Make Sure They’re In This With You

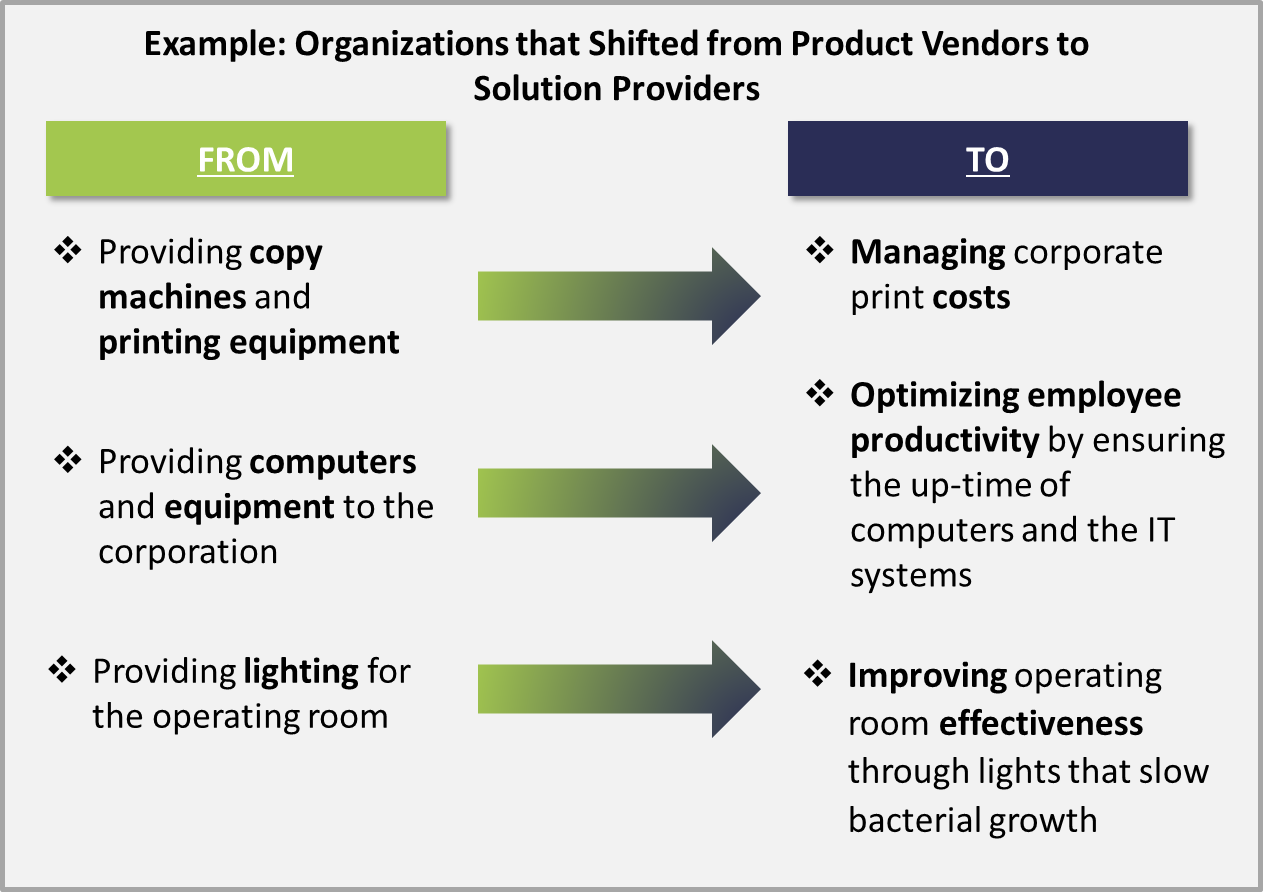

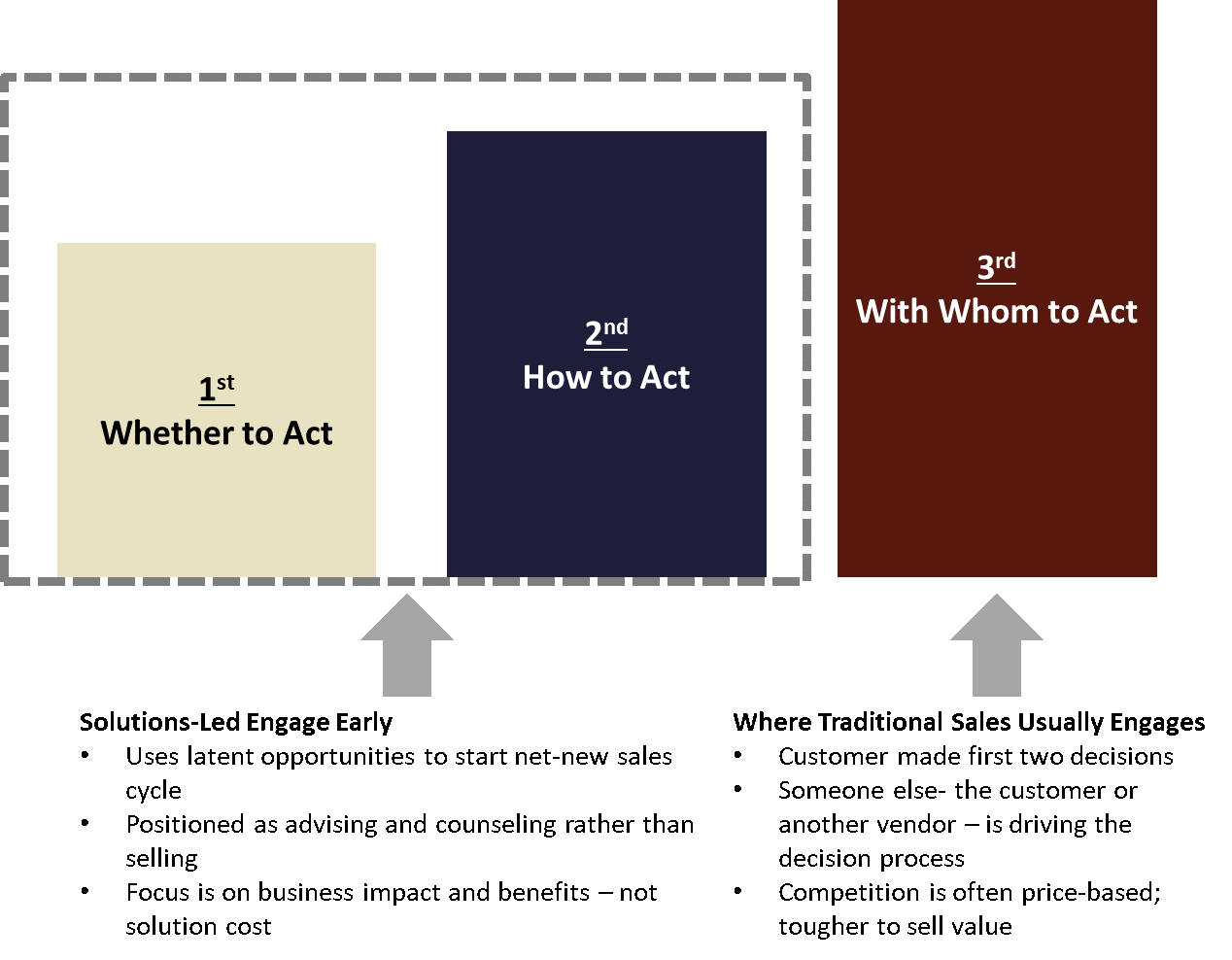

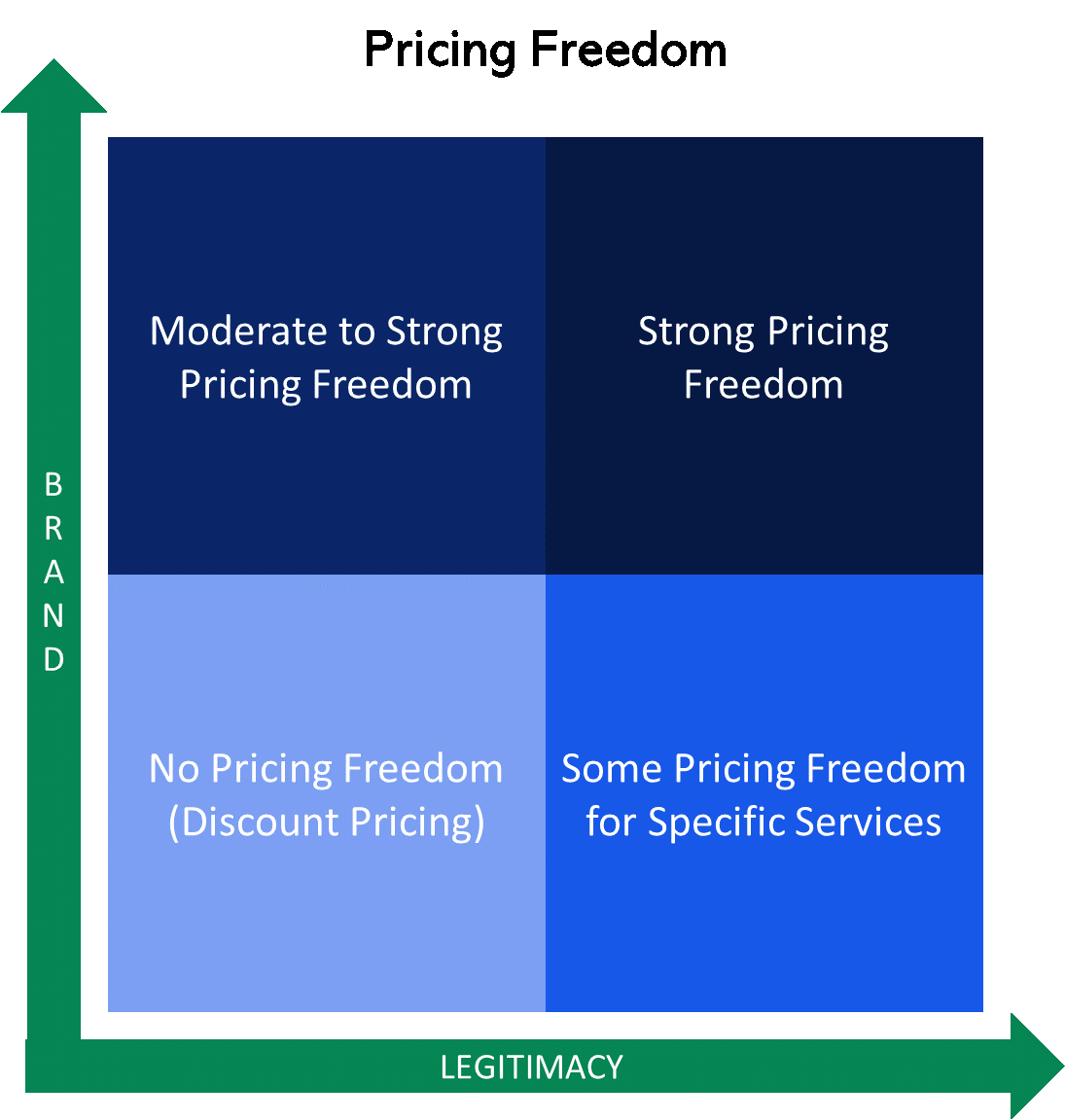

As we covered in “Setting the Stage,” innovation no longer drives success. Therefore, B2B companies are changing their business models to become more entangled with their key customers, and savvy companies are looking for Professional Services (PS) to play a pivotal role in that transformation. We use the phrase “moving from Capability-based business” to “Customer Outcome-based business,” which we discuss more in-depth in the first blog of this series.

There are other ways to make a PS business more valuable to the B2B company in transition. For example:

- PS could focus on solutions that align with the strategic plan of key customers. In healthcare, PS might work on an issue of acquisition strategy as the customers’ industry consolidates; or

- PS could focus on intimacy offers that deal with executive-level concerns: With product-centered customers, PS might solve for sales efficacy.

These approaches are equally valuable as they both allow the PS business to drive measurable customer outcomes. This is a positive event and its success hopefully encourages the customer to leverage PS more and more in their effort to renew themselves.

One of the first steps in moving to the outcomes-based model is to clarify the goal(s) and parameters for this effort. We have all worked on jobs where the complex nature of the assignment not well understood by the requester or the broader organization. Just like PS professes to its customers, it’s important to have an Initiative Charter that:

- Identifies objectives,

- Ensures organizational understanding and executive support, and

- Clarifies timeframes and financial boundaries.

As part of the Initiative Charter, ideally, the following would be explored:

- Determine if there are business outcomes that might be addressed that are directly or indirectly correlated to the product set.

- Validate that the current PS organization can effectively drive a business outcome.

- Understand the challenges PS might have in performing in this new way.

- Determine if the sales organization can sell an outcome-based program without extensive enablement.

- Assess markets receptivity to PS as an advice provider as opposed to an implementation provider.

- Gather enough experience to develop a business plan around driving outcomes.

As with any new way of doing business, planning is important. Who does what and when? Often, those who are not involved underestimate the time to become market ready with the new offer. But also, and just as dangerous, PS groups can greatly overstate the time and complexity of the effort. This “too slow” process affects PS internally and hinders executives’ motivation to undertake the effort.

In summary, like any important endeavor, the effort to have an outcome-based offer, or entire practice, must be organized, must have assured support, and must have a clearly defined vision of what constitutes success.

Written by: Dean McMann

About the Author: Dean McMann is a Founding Partner at McMann & Ransford with 35+ years of experience in consulting and professional services. He is a sought-after expert and speaker on topics of: B2B differentiation, professional services best practices, and overcoming commoditization. In addition to his extensive experience in the Professional Services space, Dean also serves on the board of various non-profit organizations.

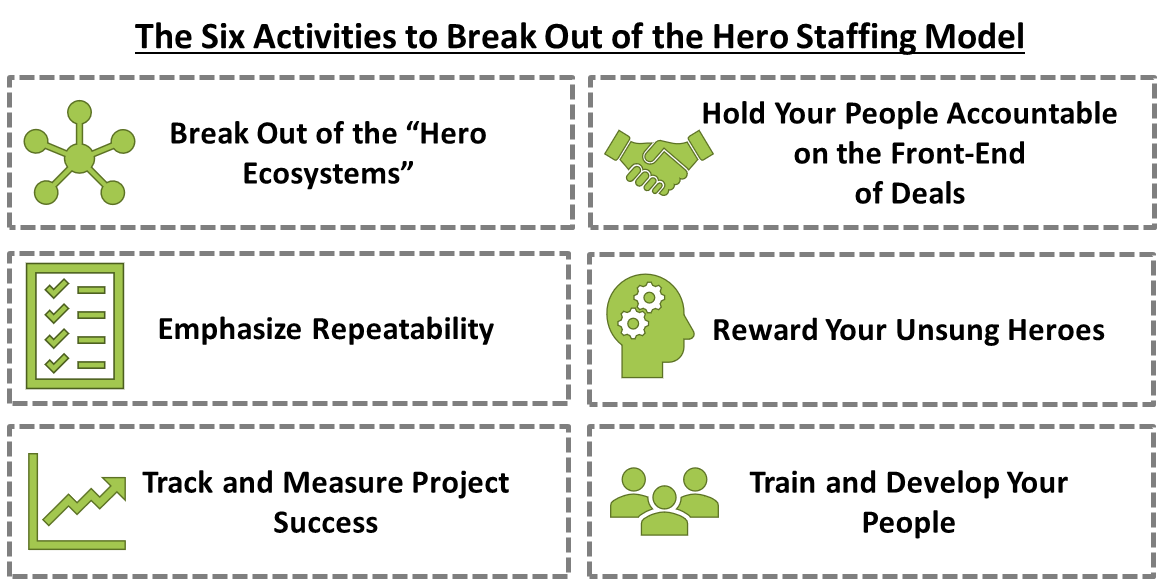

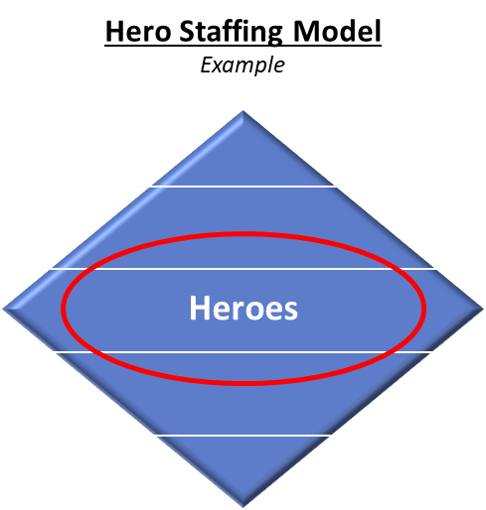

A hero-led model, however, is a diamond-shaped staffing model. Hero dependence limits growth because a proper project structure has not been created – when heroes are the center of project structure by nature, they limit how much can be done. Other limitations of the diamond-shaped model include:

A hero-led model, however, is a diamond-shaped staffing model. Hero dependence limits growth because a proper project structure has not been created – when heroes are the center of project structure by nature, they limit how much can be done. Other limitations of the diamond-shaped model include: