Roughly 70% of all strategic alliances fail.[i] For most companies, the concept of a strategic alliance makes sense and seems simple, so why do they consistently get it wrong? While partnership may sound straightforward, companies often commit four mistakes in selecting and executing alliances:

- They choose the wrong partners with misaligned strategies,

- They don’t clearly define roles or decision rights,

- They fail to implement a governance structure and review process to make sure the alliance is working as they’d like, and

- They ineffectively manage the partner relationship.

When an alliance works well, it can drive significant revenue and serve as a market attachment strategy. This allows you extend your reach in the market by expanding your suite of services without having to invest and develop them internally. It also lets you engage and become relevant in new ways with additional offerings. However, if your partnership isn’t designed and executed properly, it will provide your customers with another company to bond with or will be a frustrating, fruitless experience for both partners. If you want to succeed and avoid the four common mistakes, there are some key things you must consider.

- Selecting the Right Partner

Defining the Alliance Strategy

The first mistake companies often make is in picking the wrong partner. A company might choose a partner with different strategic goals or one that is unwilling or unable to do what is expected. Effective strategic alliance strategy requires you to understand what you are trying to achieve with the strategic alliance. Are you creating the strategic alliance to:

- Provide you access?

- Expand your solution?

- Increase your reach?

- Fill a capability gap?

You want to recognize how these factors fit into your broader commercial plan. When evaluating these questions, we suggest you apply an integrated model that looks at the segment and geography of what you need, why you need it, and how to fulfill it. This integrated model is your strategic alliance strategy. Applying this model is what will drive you to be different than the many defective alliances.

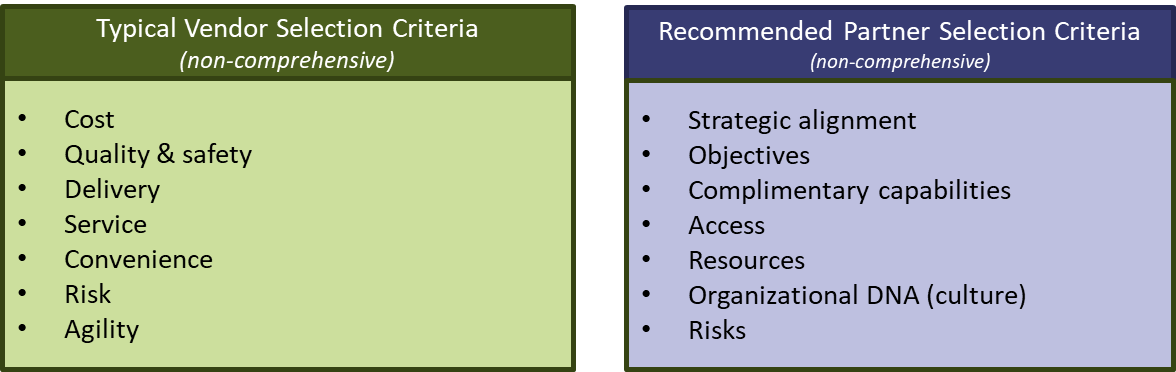

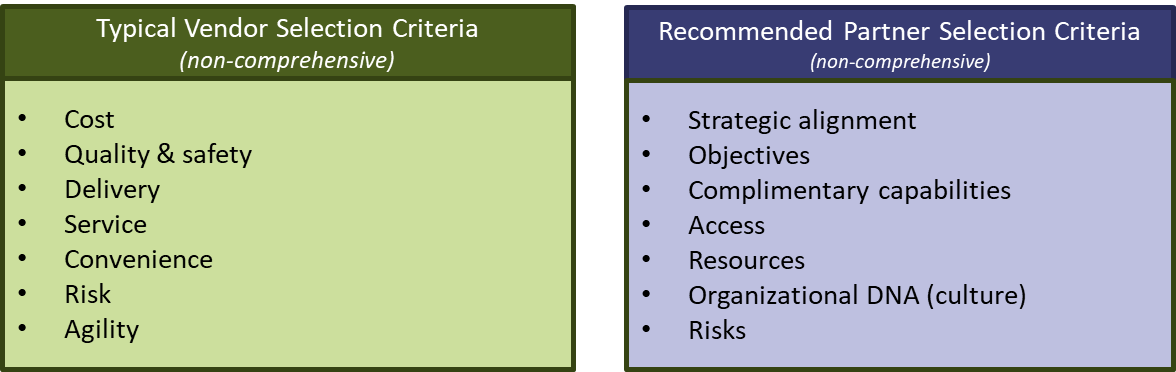

Selecting the Right Partner to Support the Strategy

Your strategic alliance is a direct reflection on your business. Because of this, it’s important to evaluate what the partner is bringing to the table. Unfortunately, many companies we see approach partner selection as they approach vendor selection. They focus on cost, quality, delivery. Partner selection is a very different process, however. You need to look at:

- How an alliance or partner makes money,

- their DNA,

- their strengths, and

- why they want this partnership.

Compare your partner’s business and motivations to your own. What are your expectations? What are your needs? From here, you can align the interests of both businesses and conduct a gap analysis to understand what must change for the relationship to work. And, there are always things that must change.

- Preparing Your Organization to Support a Network of Alliance Partners

How do we make sure that the alliance is successful? In this step, you might bring an organizational chart and have a discussion around talent alignment. To enable your business, you will need more than just an organizational chart. You need to know who is responsible for doing what. You are establishing decision rights, expectations, compensation plans, executive involvement, review committees, and the support necessary for any other revenue generating function.

This is critical in enabling Strategic Alliances, because many of these activities do not naturally demand daily attention. It’s not in our normal functional structure to have quarterly operational reviews, HR reviews, financial management reviews, or pipeline management integrated with our regular pipeline. It’s even more important to be structured, organized, and like any other new initiative such as a new program, segment, or topic, to conduct early reviews.

- Ensuring Successful Implementation of the Program

Once you’ve set the stage for success, you need to gear up for implementation. Ensuring success for any new or different initiative in a large company requires a great deal of focus from the executive organization and the appointment of leadership who are respected by the broader organization. It also calls for:

- Celebrating early wins

- Promoting of alliance activity,

- Educating the rest of the business on:

-

- Why this is important,

- How it fits into the organization, and

- How to enable the alliance and partners to be successful.

Offer up unique elements and customized support to further drive your partner’s success. When looking at your partner, consider how to take the extra step toward success and ask yourself whether they need a unique solution, training, or a larger team assigned to them. Discuss whether they need group sales teams or require a different kind of education. These unique attributes or factors are either marketing-related, sales-related, or true offers that are unique to them.

The best strategic alliances we’ve seen have something unique to give their partners. You want to stand out. You want your partner to be able to explain why working with you is better than working alone or working with someone else.

- Managing Individual Partners

Finally, just like any relationship, the partnership must be tended to. Strategic alliances are founded on strong partner relationships. In addition to focus and effort around change, structure, and processes, it’s necessary to manage the Strategic Alliance to ensure the relationship remains mutually beneficial. Maintaining a strong business partnership entails:

Consistent and transparent communication: Review and discuss the strategic alliance’s progress. What has the alliance contributed to each of your businesses? Has it helped you achieve what you set out to? Has it progressed your strategy? If the strategic alliance has been beneficial, figure out how to keep it on that path. If it hasn’t, have the conversation about adjusting your strategy.

- Establish a defined process for mediation: If any issues arise, you want to understand how you and your partner will collaboratively reach a resolution.

- Update and discuss expectations for you and your partner: Revisit expectations because they will likely evolve over the course of the relationship. Ensure that you are both committed to the alliance and willing and able to fulfill each other’s business needs.

Summary

A strategic alliance, when executed correctly, can power your business forward and help you do things you could have never done alone. Working with the right partner in the right environment will drive long-term results for both businesses. Before you set out, don’t forget the importance of:

- Evaluating and selecting the right partner for your business,

- Establishing decision rights, processes, and a learning infrastructure to educate the business on the alliance,

- Determining where the alliance fits in the greater business structure, and

- Managing your partnership to ensure you are both meeting desired strategic objectives.

[i] Danielle Twardy, “Partner Selection: A Source of Alliance Success,” University of Technology.

Written by: Marc Cottle

More from this Author

About the Author: Marc Cottle is an experienced sales leader with 15 years of experience; he is a Principal with McMann & Ransford and leads the Commercial Practice at the company.