Many corporations have added Professional Services (PS) to their businesses to drive greater customer intimacy and differentiation. But, how do ensure you’re maximizing the benefits? If you’re looking to unlock greater opportunity provided by your PS business, consider the following questions:

- What is the role of PS in your overall strategy: For most product-based companies, PS cannot drive significant enough revenue on its own to greatly impact growth or valuation. The primary function of the embedded PS wheel is to enable the big revenue wheel (i.e., core products and services) to improve outcomes for both the client and your broader organization.

There are three keys ways that PS drives the bigger revenue wheel:

1) Providing differentiation

2) Creating intimacy with your customers

3) Pulling through your products and services

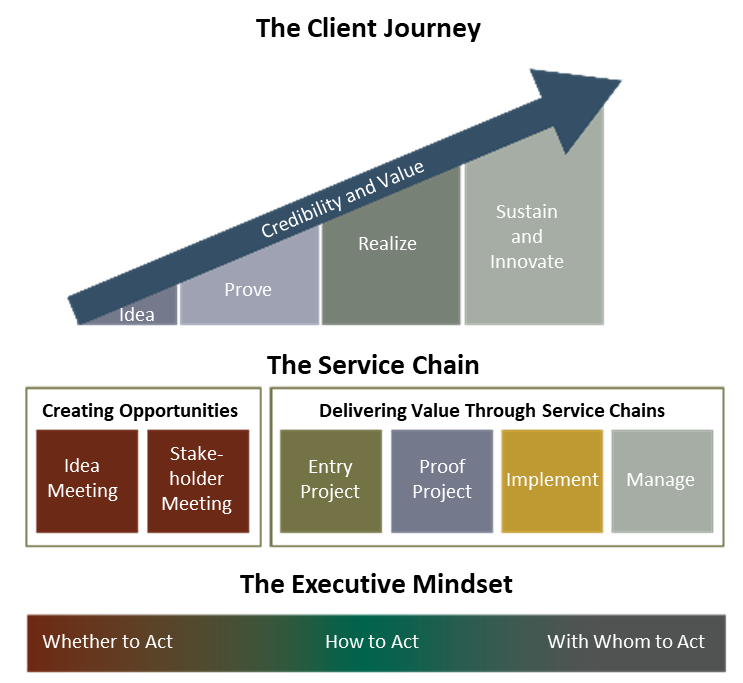

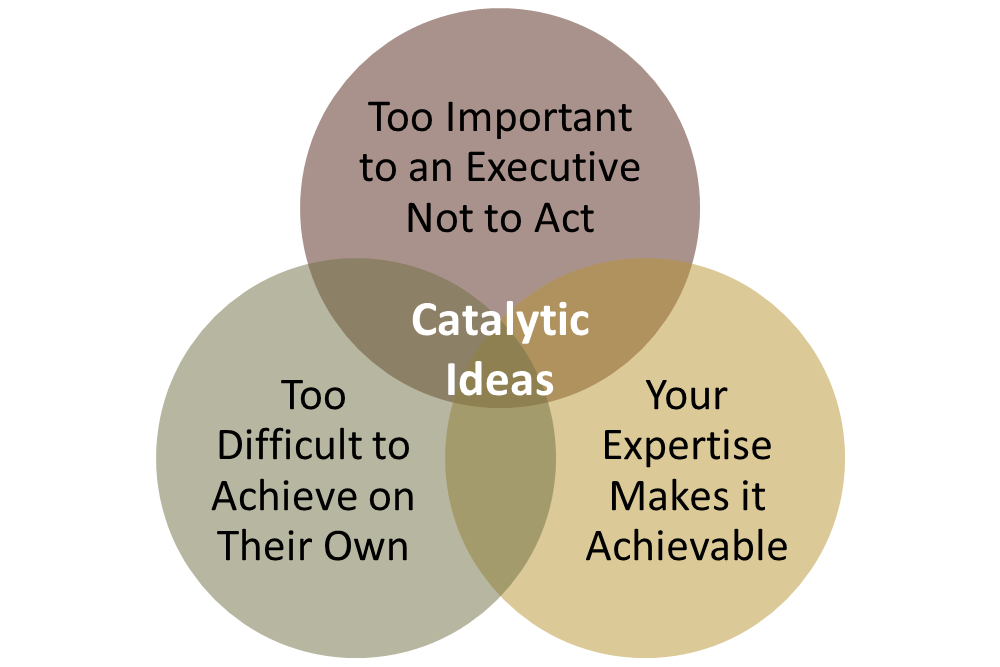

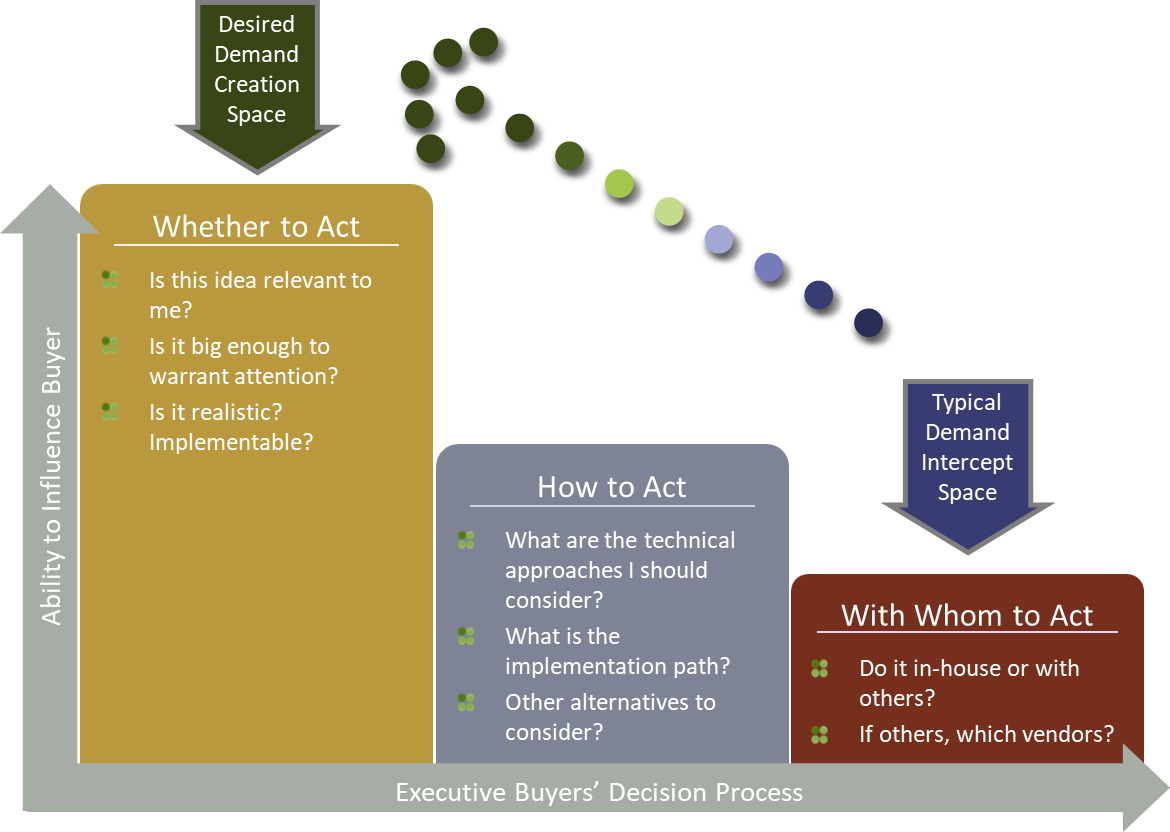

- Are you applying PS correctly to fit that role? Once you define the objectives of your PS business, you can apply PS to achieve objectives that fulfill its role in your strategy; PS can serve a multitude of purposes, including but not limited to: generating demand, guiding clients with impactful ideas, moving above the Line of Safety, De-risking the Purchase Process, and engaging through a Land and Expand Lifecycle.

These benefits can be accomplished through more specific strategic approaches such as:

- Entering new accounts

- Protecting your share of wallet at current accounts

- Growing your share of wallet at current accounts

- Pulling through specific products and services

- Maintaining relevance between purchase or renewal cycles

- Are you deploying PS in the right places?

In addition to defining the purpose of PS within the business, you should establish where PS will have the greatest impact in the market. This entails determining which segments PS can provide you the greatest impact.

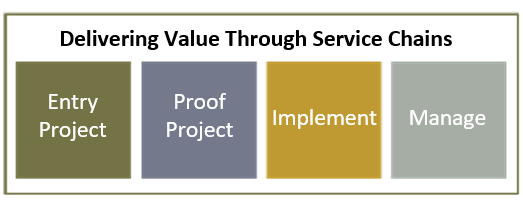

Additionally, you must consider the effect on your portfolio. Taking PS into account in your portfolio allows you to express your portfolio across an account lifecycle. PS should provide new account entry offers, offers that maintain customer intimacy across the life of an account, and offers that drive the account on buying journeys of products and services.

- Is your PS business running according to best practices?

Once you’ve developed an understanding of your high priority segments and how to serve them, you can unlock the full benefits by implementing PS best practices.

You can analyze PS performance by reviewing diagnostic indicators including: project margin, realization, utilization, and account growth.

Then, to address the PS diagnostic indicators, you should leverage a framework (such as our 8 Pillars) that categorizes best practices into focus areas. For example: Value Proposition, Brand/Legitimacy, Client Intercept, Service Lines/ Offerings, Financial Management, Organization and Talent, Practice Management, and Delivery.

- Is PS properly Interfacing with Your Commercial Organization?

PS is a powerful enabler of the commercial organization, but it must be integrated and leveraged to fulfill its mission. PS requires a new selling motion and often proves to be difficult to shift into because it requires the sales team to think and act differently. It allows you to intercept your customer’s natural buying mindset earlier than usual. It also shifts the role of your salesperson from the communicator to the coach and the validator. Because of this, it is important to be deliberate about how you integrate it into your sales and account management organizations.

PS has the ability to unlock a tremendous amount of value for you and your customers. To understand how to fully enable PS, access the presentation and whitepaper by clicking here.

Written by: Dean McMann

About the Author: Dean McMann is a Founding Partner at McMann & Ransford with 35+ years of experience in consulting and professional services. He is a sought-after expert and speaker on topics of: B2B differentiation, professional services best practices, and overcoming commoditization. In addition to his extensive experience in the Professional Services space, Dean also serves on the board of various non-profit organizations.